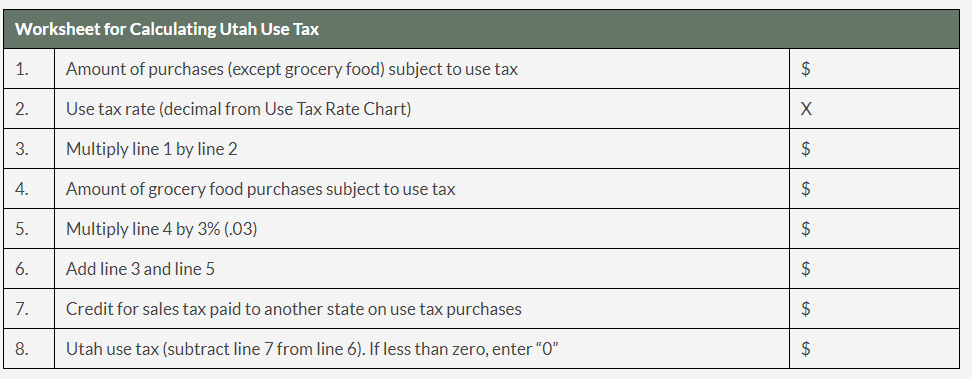

utah county food sales tax

The st george utah sales tax is 635 consisting of 470 utah state sales tax and 165 st george local sales taxesthe local sales tax consists of a 010 county sales tax a 100 city. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and.

Utah Sales Tax Small Business Guide Truic

Both food and food ingredients will be taxed at a reduced rate of 175.

. Some cities and local governments in Cache County collect additional. What is the sales tax rate in Utah County. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales tax rate of 175.

These transactions are also subject to local option and. Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice. Wayne County Sales Tax.

Utah County Sales Tax. Uintah County Sales Tax. Monday - Friday 800 am - 500 pm.

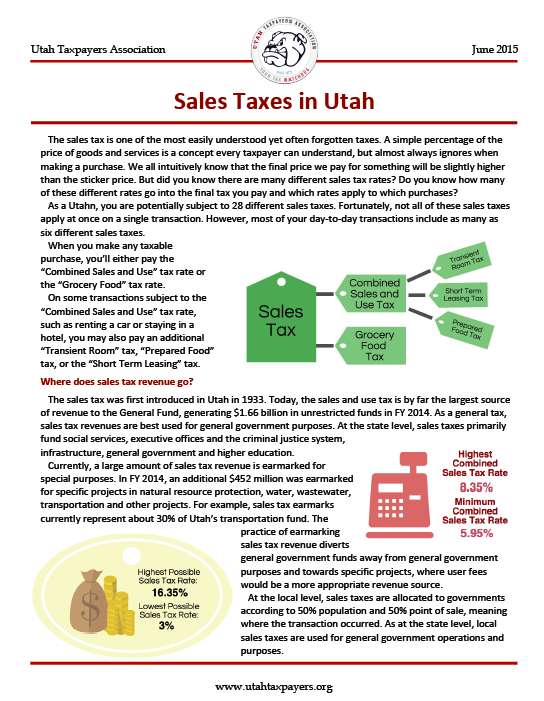

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. The Utah state sales tax. 2022 Utah state sales tax.

Report and pay sales tax electronically on Taxpayer Access Point TAP at taputahgov using the template for form TC-62M Sales and Use Tax Return. However in a bundled transaction which involves both food. The Box Elder County Utah sales tax is 595 the same as the Utah state sales tax.

The minimum combined 2022 sales tax rate for Utah County Utah is. Restaurants must also collect a 1. 274 rows 2022 List of Utah Local Sales Tax Rates.

The state sales tax rate in Utah is 4850. Average Local State Sales Tax. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Used by the county that imposed the tax. Utah has a 485 sales tax and Davis County collects an additional 18. Wasatch County Sales Tax.

91 rows This page lists the various sales use tax rates effective throughout Utah. Exact tax amount may vary for different items. Lowest sales tax 61 Highest sales tax.

Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 211 on top of. Counties may adopt this tax to support tourism recreation cultural convention or. In the state of Utah the foods are subject to local taxes.

The Iron County Utah sales tax is 595 the same as the Utah state sales tax. Utah has a higher state sales tax than 538 of states. The 2018 United States Supreme Court decision in South.

The Davis County sales tax rate is. With local taxes the total sales tax rate. 6 rows The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax.

What taxes do businesses pay in Utah. Washington County Sales Tax. The Utah state sales tax rate is currently.

This is the total of state and county sales tax rates. A county-wide sales tax rate of 01 is applicable to localities in Cache County in addition to the 485 Utah sales tax. The tax on food and food ingredients is 30 statewide.

This includes the state rate of 175 local option rate of 10 and county option rate of 025. 100 East Center Street Suite 1200 Provo Utah 84606 Phone. The Orem Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Orem local sales taxesThe local sales tax consists of a 080 county sales tax a 110 city sales tax and.

This is the total of state and county sales tax rates.

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Sales Tax Cut On Food Seen As Long Shot In Utah Legislature Cache Valley Daily

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Is Food Taxable In Utah Taxjar

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Utah Sales Tax Rates By City County 2022

Up To 50 Off Gourmet Pizza Gourmet Pizza Pizza Gourmet

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items Taxjar

How To Get A Sales Tax Exemption Certificate In Utah

Utah Sales Tax Information Sales Tax Rates And Deadlines

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Monday Map Sales Tax Exemptions For Groceries Tax Foundation